Return Type Rate 1.01% 0.95% Return Type Rate 2.11% 3.15% Return Type Rate 4.21% 5.45% 10 Year Return Type Rate 12.21% 13.46% 20 Year Return Type Rate 22.21% 23.46% 25 Year Return Type Rate 28.22% 29.46% 30 Year Return Type Rate 32.43% 33.56% 35 Year Return Type Rate 38.44% 39.59% 40 Year Return Type Rate 42.45% 43.60% 45 Year Return Type Rate 47.48% 48.61% 50 Year Return Type Rate 50.45% 51.61%

Form M-8453 Nonresident Composite Return

A statement of information which can be used in a statement of income under IRC Section 2026, but would not indicate income on Form 2071

Schedule D (Sale or Exchange)

The income and basis for a sale or exchange of a qualifying real property, including a real property used in the purchase or development of such property, to another person.

See also: Schedule D — Qualifying Real Property

Schedule M

Generally refers to a list of transactions that require a physical inspection in order to be recorded. These include land transactions, real estate transfers, personal leases, and similar transactions. For information on how to complete a paper Schedule M, please visit our Form 2071 Instructions page.

For more information, refer to Form M-8453, Nonresident Composite Return of Income and Additional Information for Tax Return Purposes.

Section 1245 Sales and Exchanges

Sale and exchange of qualified housing to a nonresident and, therefore, not subject to the 25% tax if taxable income exceeds the exemption.

See also: Section 1295 Sales and Exchanges

Section 2431 Exchanges of Real Property

Sale and exchange of qualified real property (other than qualifying real property as noted above) to a nonresident and, therefore, not subject to the 25% tax if taxable income exceeds the exemption.

See also: Section 1325 Exchanges of Taxable Property

Section 2445 Exchanges of Qualified Real Property

Sale and exchange of qualified real property.

Get the free m 8453 2012 form - mass

Show details

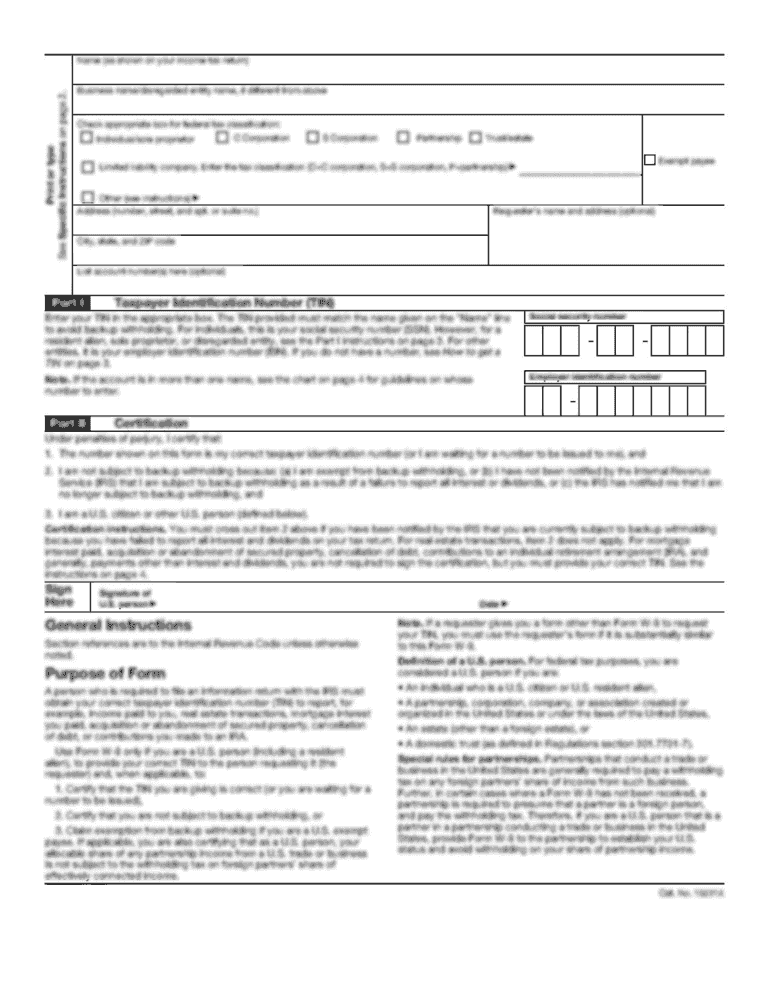

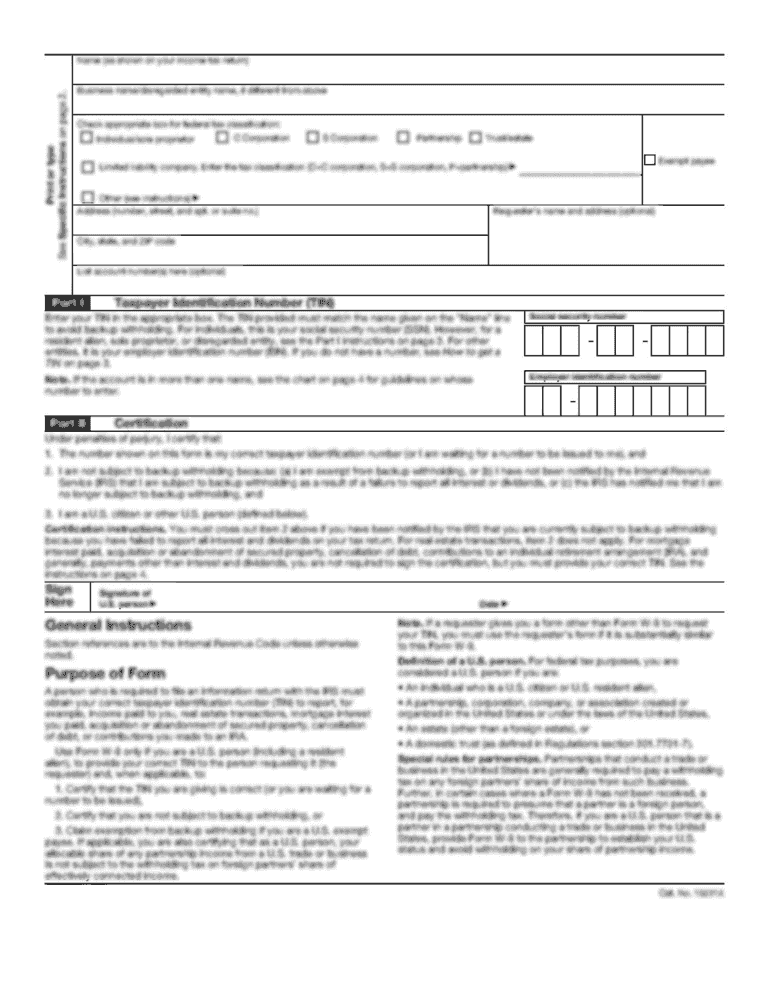

Form M-8453 CR Nonresident Composite Return Tax Declaration for Electronic Filing Massachusetts Department of Revenue Please print or type. Privacy Act Notice available upon request. For the year January 1 December 31 2012. Entity name Declaration control number Mailing address Federal Identification number City/Town State Zip Part 1. I authorize DOR to inform my Electronic Return Originator and/or the transmitter when this electronic return has...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your m 8453 2012 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m 8453 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit m 8453 2012 form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit m 8453 2012 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is m 8453 form?

The m 8453 form is a declaration document that taxpayers use to verify the accuracy of their electronic tax return before it is submitted to the IRS.

Who is required to file m 8453 form?

Taxpayers who electronically file their tax returns and need to verify the accuracy of their return are required to file the m 8453 form.

How to fill out m 8453 form?

To fill out the m 8453 form, taxpayers must follow the instructions provided by the IRS. The form requires basic personal information, such as name, Social Security number, and address, as well as information specific to the tax return being filed.

What is the purpose of m 8453 form?

The purpose of the m 8453 form is to provide taxpayers with a method to verify the accuracy of their electronic tax returns before they are submitted to the IRS. It serves as a declaration of the taxpayer's understanding and acceptance of the tax return.

What information must be reported on m 8453 form?

The m 8453 form requires taxpayers to report basic personal information, such as name, Social Security number, and address. It may also require specific information related to the tax return being filed, such as income, deductions, and credits.

When is the deadline to file m 8453 form in 2023?

The deadline to file the m 8453 form in 2023 is typically the same as the deadline to file the associated tax return. The specific deadline may vary depending on the individual's tax situation and any extensions that may have been granted.

What is the penalty for the late filing of m 8453 form?

The penalty for the late filing of the m 8453 form may vary depending on the individual's tax situation and the reasons for the late filing. It is important to consult the IRS guidelines or a tax professional for specific penalty information.

How do I edit m 8453 2012 form online?

With pdfFiller, it's easy to make changes. Open your m 8453 2012 form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit m 8453 2012 form on an Android device?

You can edit, sign, and distribute m 8453 2012 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out m 8453 2012 form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your m 8453 2012 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your m 8453 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.